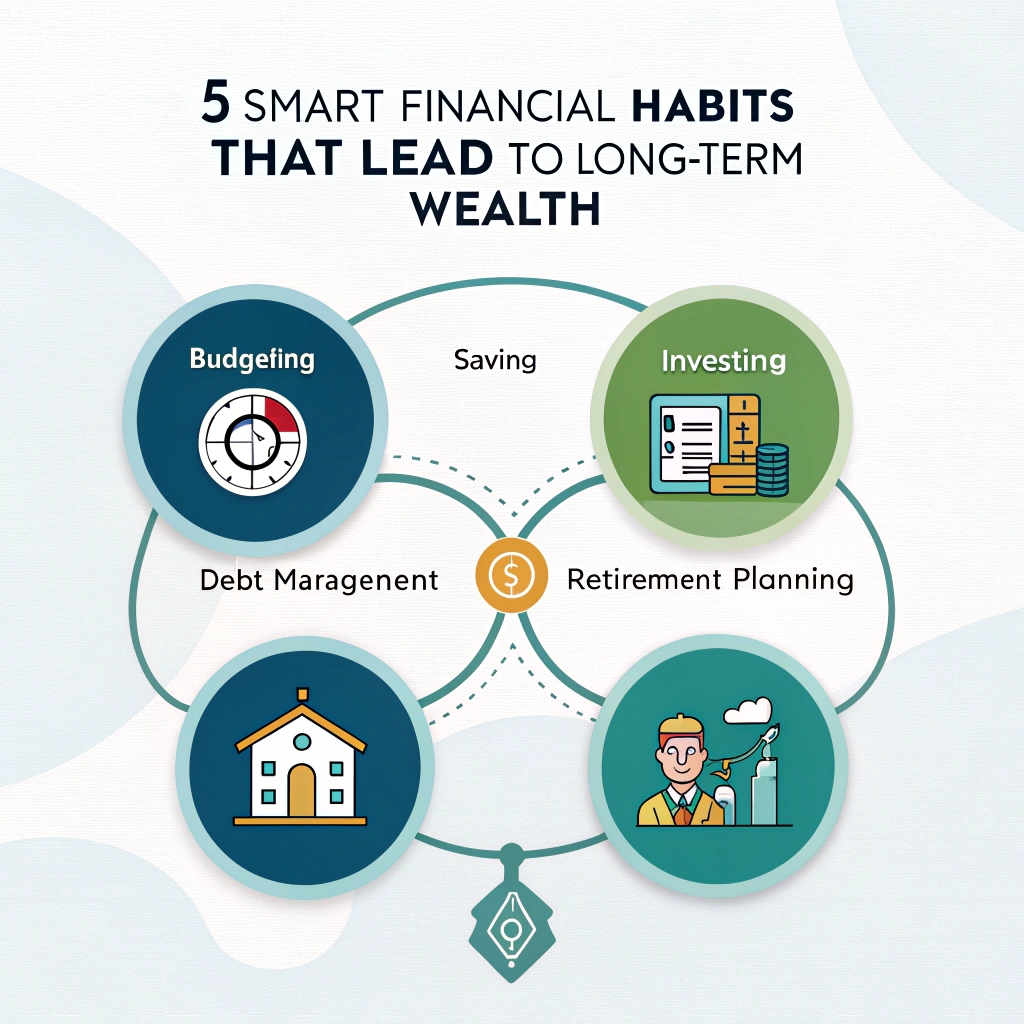

1. Live Below Your Means

One of the simplest but most powerful habits is spending less than you earn. It’s easy to get caught up in lifestyle inflation, especially as your income grows. However, consistently living below your means allows you to save more, invest more, and avoid unnecessary debt—all crucial components of long-term wealth building.

2. Pay Yourself First

Treat savings like a non-negotiable expense. By automatically directing a portion of your income into savings or investments each month, you prioritize your financial future before spending on anything else. This habit creates discipline and ensures that you're constantly growing your wealth—even if it's in small amounts.

3. Invest Early and Consistently

Time is your biggest ally when it comes to building wealth. Starting to invest early—even in small amounts—takes advantage of compound growth over time. Whether it’s through stocks, mutual funds, retirement accounts, or real estate, consistent investing builds long-term value and passive income streams.

4. Track Spending and Create a Budget

Wealthy individuals often know exactly where their money is going. Creating a realistic budget and tracking your spending helps you stay in control, avoid wasteful habits, and redirect more funds toward savings, investments, or debt repayment. Financial awareness is the first step to financial freedom.

5. Avoid High-Interest Debt

Debt can quickly derail your financial goals, especially when it comes with high interest rates like those on credit cards or payday loans. Make it a habit to pay off balances in full and avoid borrowing for non-essential purchases. Responsible debt management preserves your credit score and protects your financial future.

Developing these habits doesn't require a drastic lifestyle change—it starts with small, consistent actions. At Find and Get Finance, we're here to support you every step of the way with tools, guidance, and personalized financial strategies. Wealth isn't just for the few—it's for those who plan, act, and stick with smart financial habits over time.